Within the last few days The Guardian carried an article about the ongoing battle with the Government over the inequality in the treatment of Police widows across the UK.

The matter has now been placed before the High Court in Manchester with an expectation that it will be heard over the next year to 18 months.

This link is to the article on the national NARPO website — https://www.narpo.org/widows-pension-life/

NARPO also issued a comprehensive briefing note to The Guardian which is reproduced below :-

BACKGROUND

Regulation C9 of The Police Pensions Regulations 1987 sets out rules relating to the removal of pension award when widows and widowers remarry or cohabit.

On 21 March 2014, Northern Ireland Justice Minister David Ford announced that all survivors of members of the RUC pension scheme should retain their pensions for life, meaning widows, widowers and civil partners whose pensions had ceased on remarriage or cohabitation would be able to apply to have them reinstated.

As a result of that decision, the National Association for Retired Police Officers (NARPO) launched one of their biggest campaigns to date – ‘Widows Pensions for Life’ to try and bring this change into force across the UK.

In response to NARPO’s campaign, the Government responded with a change to the Police Pension Regulations and the Police [Injury benefit] Regulations in 2017. The change meant that survivors’ pensions, paid in respect of 1987 scheme members, would no longer be subject to the above rule when a police officer dies on duty or as a result of injuries received on duty. In England and Wales, this change only applies however to widows, widowers or surviving civil partners, who remarry, form a civil partnership or cohabit on or after 1st April 2015. This change came into force retrospectively from 1st April 2015.

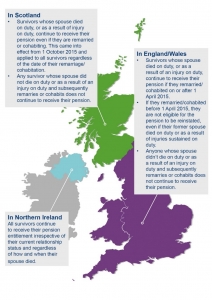

The result of these piecemeal changes means that there are now three different approaches to survivors’ pensions across the UK. In Northern Ireland, all police widows/widowers retain their widows’ pension upon remarriage, co-habitation or civil partnership irrespective of the circumstances of the death of their spouse. This is unlike every other region, where the pension is only retained if the death of the spouse occurred on duty or as a result of an injury on duty.

To further complicate matters, in England and Wales the pension is only retained if the remarriage or cohabitation occurred after 1st April 2015, whereas in Scotland there is no such restriction.

The below infographic provides more information:

All police widows and widowers have the right to be treated the same regardless of their personal relationship status. In England, Wales and Scotland, the unfair approach towards survivor’s pensions puts many in an extremely difficult position, forced to make a choice between financial security or isolation.

NARPO has continued its campaign to call for a UK-wide policy on survivor’s pensions which would see those who remarry or cohabit after the loss of their spouse, retain their pension entitlement in full regardless of how their spouse died. This is the current model in Northern Ireland and is the UK-wide policy for widows, widowers and civil partners of Armed Forces personnel.

The UK Government has said that in order to ensure that public services remain affordable, it is not possible to pay pensions to widows and widowers in England and Wales who do not meet the current criteria. However, in a report issued by the Government Actuary’s Department, it is stated that between 2012-2016, 5631 police pensioners were identified as having no dependent. This means that despite paying for survivor benefits, funds paid into these pensions will never be claimed. By comparison, in the same period, just 77 pension schemes ceased due to remarriage.

Spouses and partners of police officers make an immeasurable contribution towards public service which often goes unrecognised. Due to the nature of a police officer’s work, it would be very difficult to have both a career in the force and a family without the support of a partner at home. The support provided by the spouse of a police officer is crucial both emotionally and practically.

NARPO believes this fundamental inequality need to be addressed, and that the entitlement needs to be aligned to a UK-wide standard.

CASE STUDIES

NARPO has many case studies that have been shared with them by both those who have had their pensions taken away, and those who have decided they cannot face losing their pensions.

NARPO put together the following video which details some case studies.

Case studies of those who have chosen reluctantly to keep their pension

Person A – My husband, a safer neighbourhood officer took his own life in 2006 after an issue at work. He was ex RAF Regt, he was head hunted by the Police after a very successful stint elsewhere doing the same work. His death was a total shock, he had not suffered with mental health issues before.

I was 42 years old with an 18-year-old son. I’m now 55 years old and the prospect of living another 30 + years on my own fills me with dread. I did contact my MP some years ago to plead my case to the then Policing Minister Mike Penning. I pointed out that we had an open verdict at the inquest, that the ‘policing issue’ seems the most likely reason to why my husband took his own life (he never left a note) and the fact that holding a warrant card should mean he is a police officer 24/7. But it fell on deaf ears.

Person B – I am an 82-year-old widow of a former policeman, who I lost 16 years ago. Owing to the existing policy I am now condemned to living a very lonely life, having no family at all, with no-one to care for me should the need ever arise and having no companionship due to the fact that if I cohabit or remarry I will lose my late husband’s pension.

Person C – My husband died 10 days after his retirement date in 2004 leaving behind myself and our seven-year-old daughter. I am in receipt of my spouses’ pension as was my daughter until she finished full time education.

I feel aggrieved on a few points because both my police pension and state pension have seriously impacted on my life. Not only has it stopped me from moving on and finding happiness with anyone else because of fear of losing my police pension. My life has been further impacted financially because there is no longer a widow’s pension from the state and financial assistance from my husband’s own NI contributions that a wife can claim.

On top of all that I found out 3yrs ago that my own state pension age was rising from 60 to 66. I am one of the 1950s women that are fighting for the injustice of been given no notice that their pension age was going up so given no time to plan any future financially.

On the back of all this I had to downsize my home considerably to be able to make ends meet. I work in a very physical job which I can barely do anymore, let alone do it for 6 more years and am beginning to get more and more age-related ailments that are sometimes difficult to cope with. So I feel very aggrieved that I have been punished in more ways than one, that someone who has worked all her life, paid all her dues (51 yrs NI by the time I retire), never claimed a penny in benefits but has been put in a situation not of her choosing. Also, I would be penalised if I moved on and found someone else. It is the fear of losing my spouse’s pension most of all because I know if I did, my state pension when I receive it will not be enough on its own.

Case studies of those who have lost their pension

Person A – My husband died in 2008. I received the pension as do both of my two daughters. I met someone in 2010 and we sat down and worked our finances out to live together with our 6 children in 2012. We lasted 3 years. It was such a financial burden for us to try and live off just his wage coming in that it formed cracks. I lost all my own financial independence. I left in 2016. I had to fight to get my widows pension reinstated and it took about 4-5 months. There is no way now I will consider ever living with someone again because I simply can’t afford it. I have had to put my own career on hold to be able to look after our children alone. They are now 12 and 15. My next worry is that when they leave school, I will lose their part of the pension as well as any tax credits I receive but I haven’t been able to work the hours I would like to get back into the work force. I’m on countdown to how and when I will survive financially in the future.

Person B – I retired from the Police in 2004 after completing 30yrs of service. My wife was also a serving officer. She retired in the mid-80s when we began our family. She re-joined in the early 90s, first as one of the first part-time officers and then progressing onto full time. Her area of expertise was Child Protection. As such, around 2002 she was seconded onto Operation Ore. You may know that this was the international investigation into online child abuse. She suffered greatly from being involved in this investigation, so much so that she later underwent counselling. Unfortunately, she never fully recovered, and she was subsequently retired on an Injury Pension in 2008.

We managed to have a few good years of retirement together but unfortunately, she was struck down with cancer in 2012. She was only 53yrs of age. The medics told us that the cancer she had developed, an osteosarcoma, was extremely unusual in an otherwise fit adult. She had been a fitness freak throughout her life.

She passed away in 2013, less than a year after the cancer was diagnosed. Since then I have remarried. The lady I am married to is herself a widow. Her former husband had served many years in the Royal Navy. He also succumbed to cancer. He developed the cancer years after retiring from the Navy, yet my wife has been informed that her widows’ pension from the Royal Navy is safe and she will never lose it. I do not understand the incompatibility of the two.

I should point out that my first wife’s injury was PTSD. She developed it as a consequence of the Op. Pre inquiry. This condition stayed with her for the remainder of her life, although being out of the environment that had caused it, helped her greatly to manage it.

Naturally when my first wife died, I became beneficiary to half her pension, without the Injury Award part. Since remarrying, I am now without the Widow’s Pension – unlike the case of my second wife and her Widow’s Pension.

Person C – (if her husband had been serving in Scotland at the time of his death, and due to the fact that she was therefore in receipt of a special pension – she would have had her pension reinstated and back dated to 1st October 2015.)

My husband died on duty in a road traffic accident in June 1998. I met him in January 1978 when I was 19 through a mutual friend who also worked in the Police. We very quickly knew we were in love and married in 1980.

Our daughter was born in 1983, and nearly three years later in 1986, our son. Our family was complete. Because of the unpredictable nature of his job, it was decided that I would stay at home with the children to give them a consistent and secure environment. We went without quite a lot of material things, but we were extremely content.

In 1992, our life was shattered, when our beloved daughter was diagnosed with an inoperable brain stem tumour at the age of 8. The prognosis was extremely bleak and was probably the darkest time in our lives. My husband carried on working to support us all at this terrible time. The radiotherapy managed to shrink the tumour, and against all the odds our daughter survived.

I am extremely proud of my late husband, who throughout his career gained many commendations for his dedication to his Police work. His work was dangerous and sometimes, I didn’t know when I would hear from or see him again, as obviously this work was extremely confidential. I could wake up in the morning, and he wasn’t there. This is a part of a Police Officer’s very unique career, and as Police Officer’s wives, we accepted our role as the security and stability at home.

In June 1998, I had just given the children their dinner, when there was a knock at the door, the knock that changed our lives forever. There were two police officers at the door who gave me the news that no wife ever wants to hear. My late husband served in the Police for 22 years and was only 8 years from his retirement. He always assumed that I would be looked after for life if anything happened to him. I brought up my children to adulthood on my own and am extremely proud of them both. My daughter is still on a lot of medication, and has many health problems, including depression. We all bear hidden scars which will never heal.

I never thought I would fall in love again, but in time I met a lovely man and remarried in 2012. I had to choose staying on my own for the rest of my life or finding love again. I chose love, but also lost my security and independence that my husband thought he had provided for me. If I had divorced my husband, I would probably have been entitled to financial security for the rest of my life. I was very happy when I found out that the Army Widows would keep their pensions, along with the Northern Ireland Police Widows. All I am asking for is parity along with them.

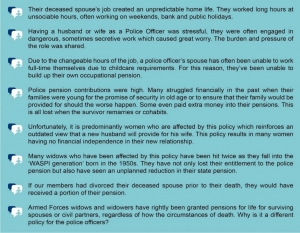

We have spoken to many people who have been directly affected by this policy through either cohabitating with a new partner or remarrying or deciding not to. We hear the same things from them:

CAMPAIGNING & PARLIAMENTARY SUPPORT

NARPO has campaigned for a number of years to reverse this unfair policy. This has included regular communication with the Home Office to set out the case of their members and others, to no avail.

NARPO has been successful in gaining cross-party parliamentary support for the reversal of this policy. On 1st May 2019, they held a parliamentary drop-in which had nearly 60 cross-party MPs in attendance, who took forward various parliamentary actions including tabling questions to Government.

Additionally, Holly Lynch, Member of Parliament for Halifax tabled an Early Day Motion (EDM) in support of NARPO’s campaign which received 56 cross-party signatories.

THE CLAIM

Proceedings brought by five widows and widowers of former serving police officers, issued out of the High Court in Manchester, have been served on the Home Secretary, Priti Patel on Friday 21st August 2020.

All five Claimants would lose their Police Widow’s Pension if they decided to remarry or cohabit with a new spouse or partner. The proceedings are representative of a significant group of widows and widowers, all of whom will lose their financial lifeline if they remarry or cohabit. If successful however, the proceedings will have significant implications for hundreds of widows and widowers who have already lost their Widows Pension by remarriage or cohabitation.

The proceedings claim a Declaration against the Secretary of State under the Human Rights Act. It states that Regulation C9 of the Police Pensions Regulations, and its enforcement by the Secretary of State to terminate the pensions of widows/widowers who remarry or cohabit with their new partner, is unlawful. Specifically, Regulation C9 is in breach of a widow/widower’s Right to marry, their Right to respect for private and family life and the Right to not be discriminated against.

If successful, the proceedings which are being brought as a Test Claim, will affect hundreds, potentially thousands of widows and widowers, whose lives and those of their families have been blighted by Regulation C9.

It is anticipated that a Trial will take place sometime in the summer or autumn of next year. The proceedings are being supported by both NARPO and the Police Federation.

The case is expected to be one of the most significant challenges in relation to Human Rights Convention that the Manchester High Court will have to consider to date.

QUOTES

Xxxx, NARPO:

“We have been campaigning to remove this archaic and unfair regulation for a number of years, due to the restrictions it places on the rights of widows and widowers.

We fully support the claimants and know that this issue is far reaching beyond the five individuals involved. NARPO has countless personal stories of victims and their families, and we know there will be hundreds of others, who we aren’t aware of, that have been affected by this.

It is extremely disappointing that the Government have not worked with us to resolve this matter, despite our repeated attempts, but we hope now that the Court will deliver justice so that widows and survivors are not faced with making the choice between financial security or isolation.”

Police Federation: [INSERT]

ABOUT

NARPO is a member organisation that represents over 93,000 members spanning all forces across England and Wales.

Formed in 1919 by a group of retired police officers, NARPO is a branch-led organisation with headquarters in Wakefield. Since that time, it has become one of the largest public sector pensioner organisations in the country.

NARPO’s members include former police officers, staff, their partners and former partners and those widowed both in and after service. The organisation strives to improve the lives of its members, whether it be in work or leisure, to thank them for the contribution they have made to our society.

The Police Federation of England and Wales (PFEW) is the staff association for police constables, sergeants and inspectors (including chief inspectors). It is one of the largest staff associations in the UK representing 120,000 rank and file officers and is governed by rules and regulations set by the Government. The main aims of PFEW can broadly be defined as to represent and support, influence, and negotiate on behalf of its members. This can cover a huge range of topics, from roads policing to health and safety, diversity, conduct and performance, and much more.